wake county nc sales tax rate 2019

FY2021-22 Property Tax Rate per 100 Value. Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Manufactured and Modular Homes.

Sales Taxes In The United States Wikiwand

85 x 7027 5973 estimated annual tax.

. County Profile Wake County NC March 2022 Demographics. Fitch Rates Wake County NCS 361MM GOs AAA. Appointments are recommended and walk-ins are first come first serve.

17 rows Wake County North Carolina Sales Tax Rate 2022 Up to 725. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. Wake County collects on average 081 of a propertys assessed fair market value as property tax.

County rate 60 Fire District rate 1027 Combined Rate 7027 No vehicle fee is charged if the property is not in a municipality Property value divided by 100. The minimum combined 2022 sales tax rate for Wake County North Carolina is. Salesperson salaries in Wake County NC can vary between 19000 to 134000 and depend on various factors including skills.

Wake County has one of the highest median property taxes in the United States and is ranked 571st of the 3143. The median property tax in Wake County North Carolina is 1793 per year for a home worth the median value of 222300. 3 rows Sales Tax Breakdown.

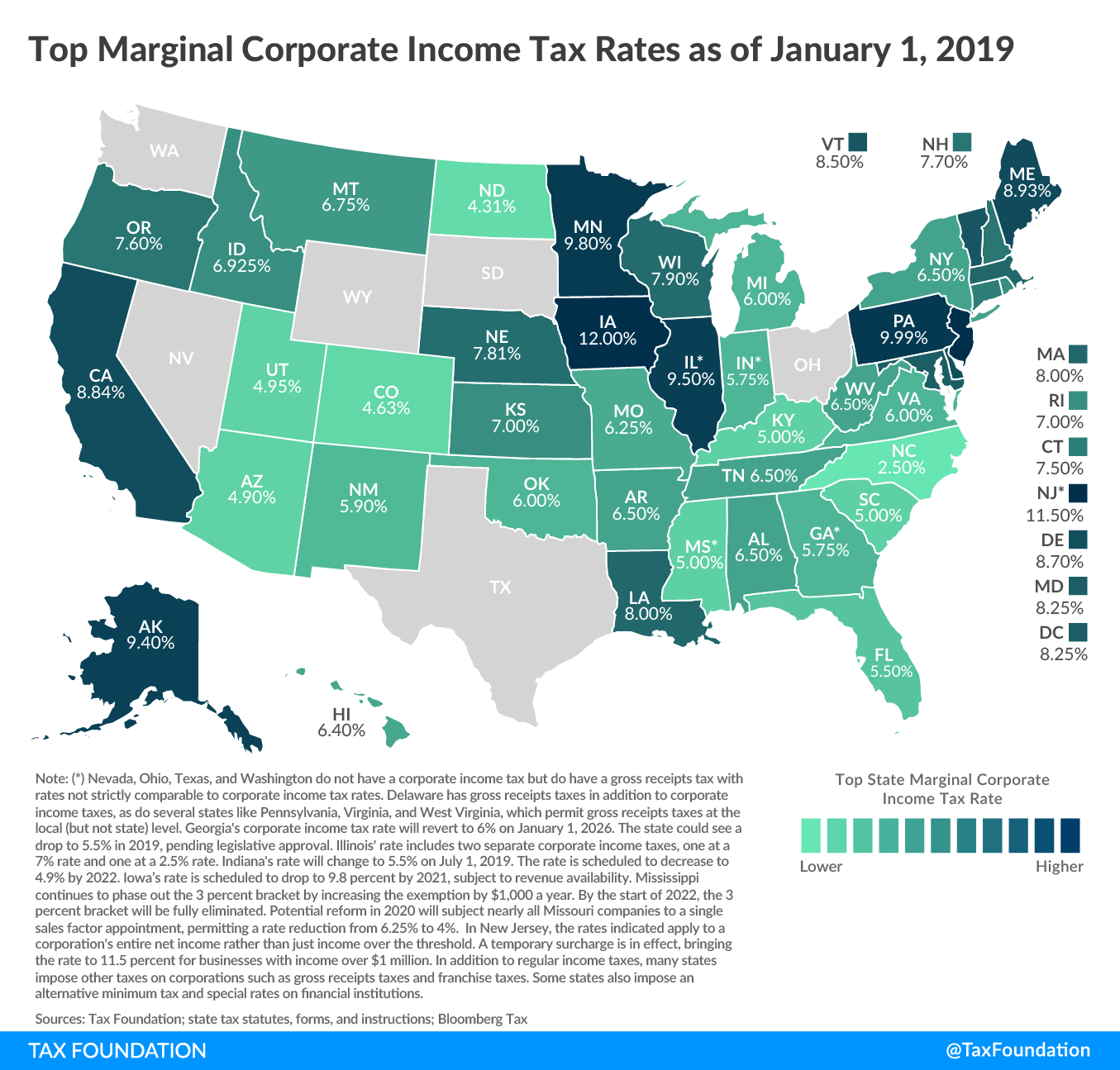

The 725 sales tax rate in Wake Forest consists of 475 North Carolina state sales. The corporate income tax rate for North Carolina will drop to 30 starting January 2017. 3 rows Sales Tax Breakdown.

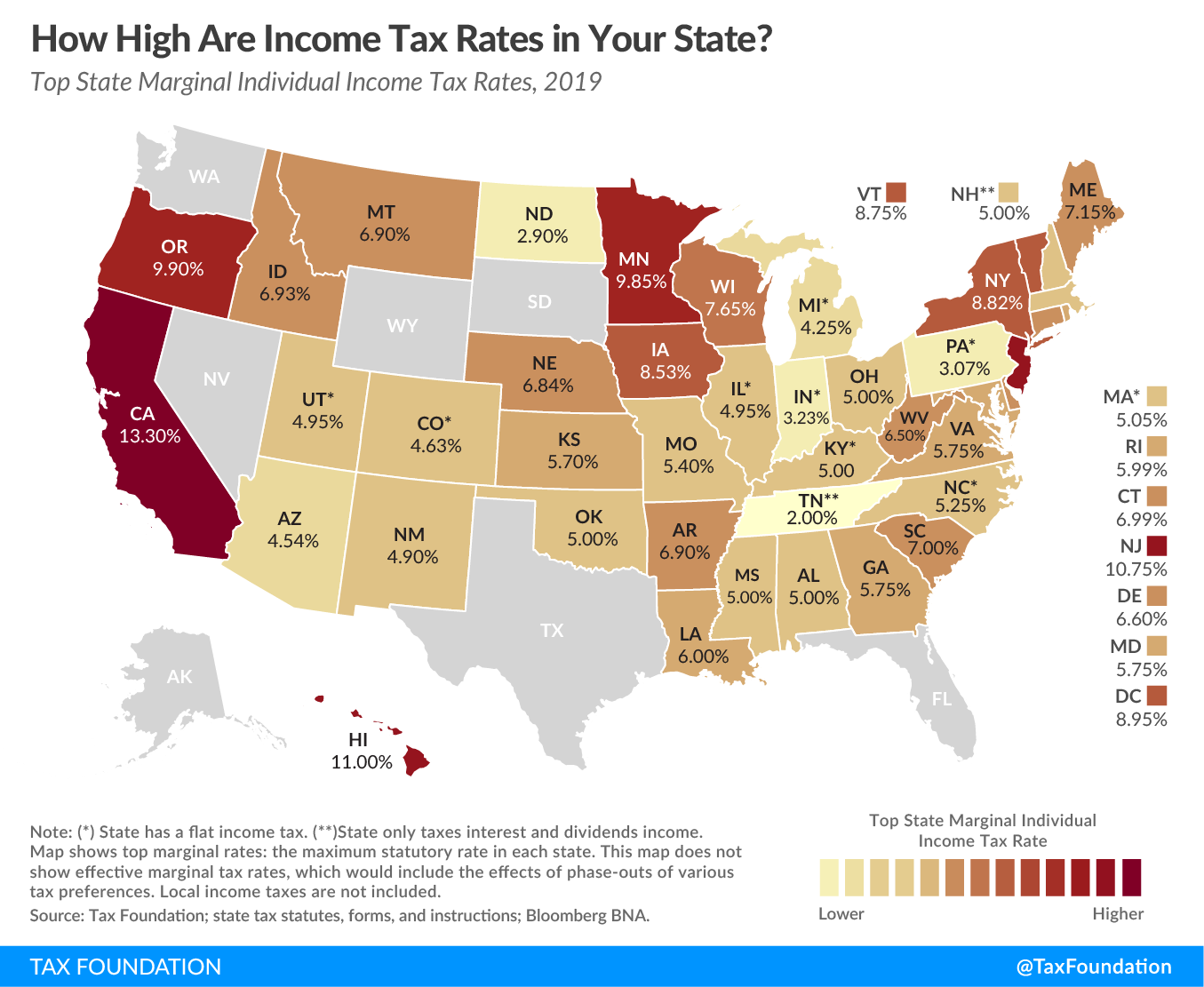

Of the 100 North Carolina counties 56 had a total sales tax rate of 675 40 counties had a total sales tax rate of 7 two countiesMecklenburg County and Wake Countyhad a total sales tax rate of 725 and two countiesDurham County and Orange Countyhad a total sales tax rate of 75. The North Carolina state sales tax rate is currently. Wake County North Carolina.

6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina. Data Files Statistics Reports Download property data and tax bill files. This is the total of state and county sales tax rates.

Fitch Rates Wake County NCS 1977MM GOs AAA. The state will phase-in a single sales factor in the 2016 and 2017 tax years with a 100 sales factor imposed in the 2018 tax year. FY2018-19 Property Tax Rate per 100 Value 06544 2018Q4 Licensed Child Care Facilities 503 FY2017-18 Annual Taxable Retail Sales mil 182737 2018Q4 Licensed Child Care Enrollment 26530 2019 Tier designation 3.

The average salary for a Salesperson in Wake County NC is 44500 per year. Ad Find Out Sales Tax Rates For Free. County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted By 5-Digit Zip.

Wake County Sales Tax Rate 2019 Coupons Promo Codes 11-2021. 2019 Est Owner Occupied Vacancy Rate 10 2019 Est Renter Occupied Vacancy Rate 58 Income Ann Growth or Pov. Fitch Rates Wake County NCS 3046 MM LOBs AA.

Aircraft and Qualified Jet Engines. County Profile Wake County NC December 2019 Demographics Population Growth Population Annual Growth 2017 Est Population 1023811 25 2010 Census Total Population 900993 44 Jul2018 NC Certified Population Estimate 1070197 UrbanRural Representation UrbanRural Percent 2010 Census Total Population. That makes the countys average effective property tax rate 088.

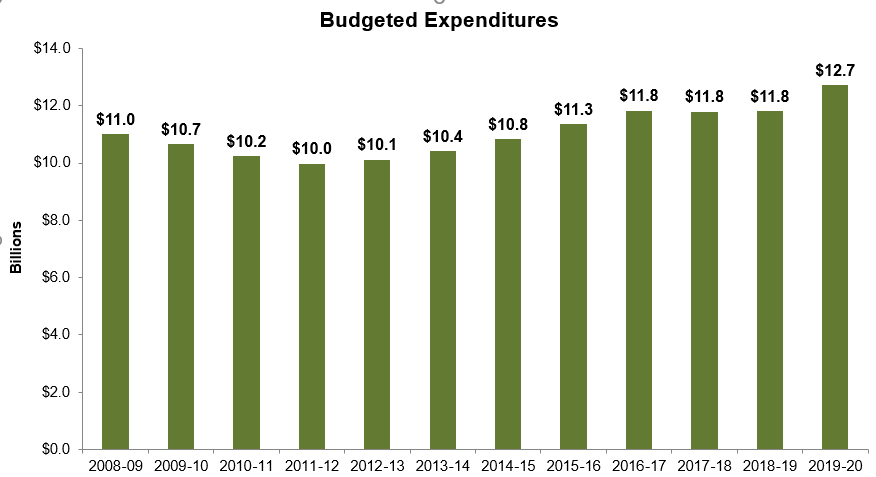

Expenditure Framework The county maintains healthy expenditure flexibility with a moderate level of. The corporate income tax rate for North Carolina is 40. Yearly median tax in Wake County.

These insights are exclusive to Mint Salary and are based on 83 tax returns from TurboTax customers who reported this type of occupation. Fitch Rates Wake County NCS 672MM GOs AAA. The county maintains healthy capacity under the statutory cap of 150 per 100 of AV given the fiscal 2019 tax rate of 06544.

Sales and Use Tax Rates Effective April 1 2019 NCDOR. The 2018 United States. Wake County North Carolina.

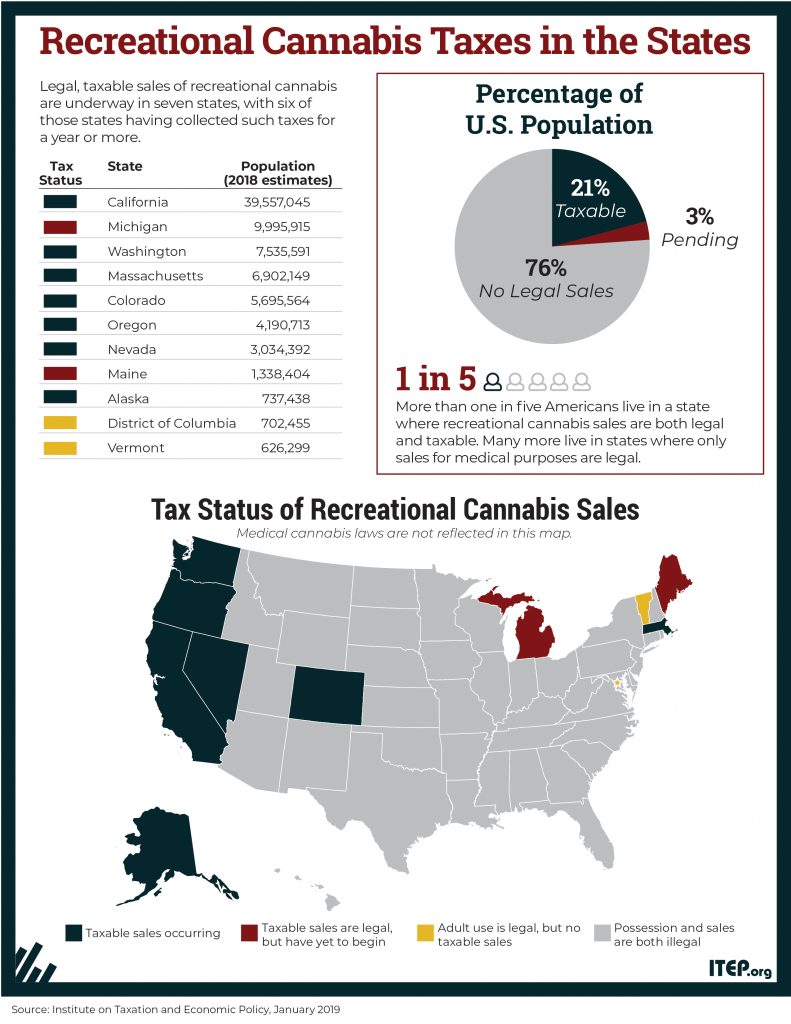

The Wake County Sales. The statewide sales tax rate was 475 as of 2019. Nearly all of these increases stemmed from ballot measures though local government officials in Wake County North Carolina of which Raleigh.

There is not a local corporate income tax. Use the Wake County Tax Portal to view property details research comparable sales and to file a real estate appeal online. Pamlico County Tax Rates County.

Fast Easy Tax Solutions. Wake County collects on average 081 of a propertys assessed fair market value as property tax. The Wake County sales tax rate is.

Wake County North Carolina. 6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina. Walk-ins and appointment information.

And local sales tax rates over the past two years including 10 with increases in the first half of 2019.

Wake County North Carolina Property Tax Rates 2020 Tax Year

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Taxes Cary Economic Development

North Carolina Sales Tax Rates By City County 2022

Taxes Wake County Economic Development

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Sales Taxes In The United States Wikiwand

Sales And Use Tax Rates Effective October 1 2018 Through March 31 2019 Ncdor

Taxes Cary Economic Development

Sales Taxes In The United States Wikiwand

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Sales Tax On Grocery Items Taxjar

Sales Taxes In The United States Taxable Itemsและcollection Payment And Tax Returns

Sales Taxes In The United States Wikiwand

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue